Companies using the accrual method could make use of unearned income to help align earnings with prices and probably defer revenue taxes until later intervals when income has been earned. Usually, it’s extra common for firms who provide providers to get paid prematurely compared to those that present a bodily product. For example, getting paid upfront means you don’t must chase up clients for overdue invoices or surprise when you’re going to receive the cash. For instance, a law firm might charge a $10,000 retainer for authorized illustration. The firm holds this quantity as unearned income and deducts from it as they complete billable work.

Our library of 200+ classes will train you exactly what you need to know to use it at work tomorrow. Baremetrics is a business metrics device that provides 26 metrics about your corporation, similar to MRR, ARR, LTV, complete clients, and extra. First, since you might have acquired cash from your purchasers, it appears as an asset in your cash and money equivalents. Principally, ASC 606 stipulates that you just acknowledge internally and for tax functions income as you carry out the obligations of your gross sales contract. Baremetrics supplies an easy-to-read dashboard that provides you all the important thing metrics for your business, including MRR, ARR, LTV, total clients, and more. Since you haven’t delivered on all the net site assist throughout the year but, you need to classify the support charge separately in your contract, and solely acknowledge that revenue as you earn it.

In any case the place the client doesn’t obtain what they ordered, then the corporate would need to repay the customer. Unearned revenue is earnings that a company receives from investments or different sources that aren’t associated to its primary business activities. It can embody things like curiosity earned on money in the company’s checking account.

What Does Revenue In Business Mean?

In some industries, the unearned revenue contains a large portion of whole present liabilities of the entity. For instance in air line industry, this legal responsibility arisen from tickets issued for future flights consists of virtually 50% of total current liabilities. Let’s assume, for example, Mexico Manufacturing Firm receives $25,000 cash in advance from a purchaser https://www.quickbooks-payroll.org/ on December 1, 2021.

Thus, proper administration of unearned income, together with accurate accounting and monitoring of the liability, is essential for a company’s success. Another way is to extend revenue and margin by adjusting your costs. Unearned revenue is a kind of legal responsibility account in monetary reporting as a end result of it is an quantity a business owes consumers or customers.

Is Unearned Income A Liability?

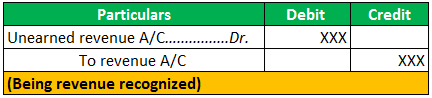

When a business receives unearned revenue, the fundamental accounting entry is to debit the money account and credit the unearned revenue account, which is a liability account. As the goods or companies are delivered, the journal entry for unearned revenue adjustments. The unearned revenue account is debited, and the income account is credited. This switch from liability to earned revenue should be unearned revenue well timed and correct, primarily based on the supply of products or completion of companies. This ensures that the company’s financial statements accurately reflect its true monetary position and performance. Unearned income, also called deferred revenue or pay as you go revenue, refers back to the payments acquired by an organization for items or services that are but to be delivered or provided.

The accounting ideas for unearned income are the same regardless of enterprise size. However, bigger companies could have extra advanced methods for tracking and managing unearned income as a outcome of scale of their operations. By using effective money administration strategies and robust danger evaluation methods, firms can navigate the intricacies of unearned income management. Adopting these practices will promote monetary stability and progress while sustaining buyer satisfaction and trust.

Unearned revenue is often categorised as a present legal responsibility as a outcome of the company expects to meet its obligations and ship the goods or providers within one yr. However, if the corporate anticipates that it’ll take more than one yr to satisfy its obligations, the unearned revenue must be handled as a long-term liability. Unearned revenue is important for companies as a end result of it offers a money flow advantage. By receiving cost upfront, a company can use that cash for operations or investments. Unearned revenue also can assist companies predict future income and plan accordingly.

Steadiness Sheet

Nonetheless, unearned revenue can additionally be a legal responsibility if an organization fails to ship items or companies as promised. If a company is unable to fulfill its obligations, it may have to refund the payment or face legal motion. Correct accounting of unearned revenue is essential for ensuring a company’s monetary stability and popularity.

Unearned income is often earned through investments, similar to interest on financial savings, dividends from shares, or earnings from rental properties. In Distinction To earned revenue, which incorporates wages and self-employment earnings, unearned income is not tied to labor. Right Here is every thing you need to learn about unearned revenue and how it impacts your small enterprise. Resorts and airways typically obtain advance payments for room bookings or flight reservations. Software-as-a-Service (SaaS) companies regularly receive prepayments for annual subscriptions. Gross Sales revenue is the revenue generated by the sale of providers and/or merchandise.

- Depending on the settlement, your fee could additionally be paid prematurely, making it unearned revenue till you ship your services for the period.

- Accounting for unearned revenue inside a enterprise can be a difficult factor to track when cash is constantly flowing in and out of a business.

- This means unearned revenue is listed as a legal responsibility in your balance sheet till your small business delivers the promised companies or items.

Understanding why customers depart, using knowledge and insights, is step one to retaining them. CFI is the worldwide institution behind the monetary modeling and valuation analyst FMVA® Designation. CFI is on a mission to allow anyone to be a great monetary analyst and have a fantastic career path. In order to help you advance your profession, CFI has compiled many resources to assist you alongside the trail.